Mortgage life insurance is a non-mandatory insurance that lenders offer which pays off your mortgage in the event of your death assuming youre the primary breadwinner In the event of an unexpected death your loan balance will be paid off in full and your estate will be cleared of any money owing. Meet Christine a 30-year-old non-smoker with a 300000 mortgage living in Windsor Ontario.

Once We Can Prove You Ve Received A Similar Level Of Overtime Over The Last 2 Years We Can Then Use That To Add To You Mortgage Tips Financial Services Lenders

Is mortgage insurance mandatory in Ontario.

. Optional mortgage insurance is a type of credit and loan insurance that you are usually offered when you. Ad The new better way to get a mortgage in Canada. The bigger your down payment the less you pay in mortgage loan insurance premiums.

One of the most common questions that arise is home insurance mandatory in Canada. Fortunately mortgage life insurance is not mandatory in Canada. Because home insurance is not required by law many clients may think they can forego buying it altogether if they dont have a mortgage.

When insurance renewal time comes they may be tempted to cancel in order to save on home insurance. If youre diagnosed with a critical illness this policy pays out the outstanding balance on your mortgage whether you can work or not. Call for a free quote today.

Mortgage Brokerage Ontario 13044. But it is always recommended that you have it whether its mandatory. Life insurance is not mandatory to get a mortgage.

If you are applying for a mortgage in order to purchase your home your lender will require you to obtain house insurance before the closing. Speak with an MW broker today for the best coverage and the best rates on mortgage insurance in Ontario. Often seniors will be denied this kind of coverage based on age.

According to The Canada Mortgage and Housing Corporation it is mandatory to purchase mortgage insurance in Ontario if the down payment falls in between 5 to 1999 of total house cost. Some mortgages require CMHC insurance or mortgage default insurance depending on the home price and your downpayment. While conditions vary usually Ontario residents between 18 and 55 can apply for critical illness mortgage insurance.

Get a low rate save on interest and get help from our Mortgage Advisors when you need it. Your premium depends on the amount of your down payment. No mortgage insurance is not mandatory to qualify for your mortgage.

Inc is an insurance brokerage licensed to sell life insurance products in Ontario British Columbia Alberta and Manitoba. Term life insurance is a cost-effective and flexible way to protect your mortgage debt. That said its smart to think about what might happen if you cant pay your mortgage.

The fee you pay for mortgage loan insurance is called a premium. Is mortgage insurance mandatory. The short answer is no.

Mortgage insurance for a male and female both non-smokers and average health. Why do you need home insurance to get a mortgage. So if youre buying for the first time or looking to move you might want to know how much youre likely to pay for home insurance in your area.

Optional mortgage insurance products are life illness and disability insurance products that can help make mortgage payments or can help pay off the remainder owing on your mortgage if you. If you are unable to keep up with your mortgage payments there are other more effective ways to. In Canada obtaining mortgage life insurance is not required by law.

This is because vehicle insurance is so many assume that home insurance may be. Mortgage insurance works as a parachute for both buyer and seller in case of adverse conditions. Home insurance is not mandatory in Ontario but it is required if you want to secure a mortgage.

But that doesnt mean that it should be neglected. Are you familiar with the concept of Mortgage Insurance or. Cost of mortgage loan insurance.

What are optional mortgage insurance products. Its not mandatory but if you have a mortgage your bank will insist that at least the structure itself be insured. While mortgage life insurance is not required by law in Canada many lenders will require borrowers to have a life insurance policy to protect the loan and while this requirement isnt legally enforceable you will need to sign a waiver stating that you do have individual life insurance if youre declining the coverage from your mortgage.

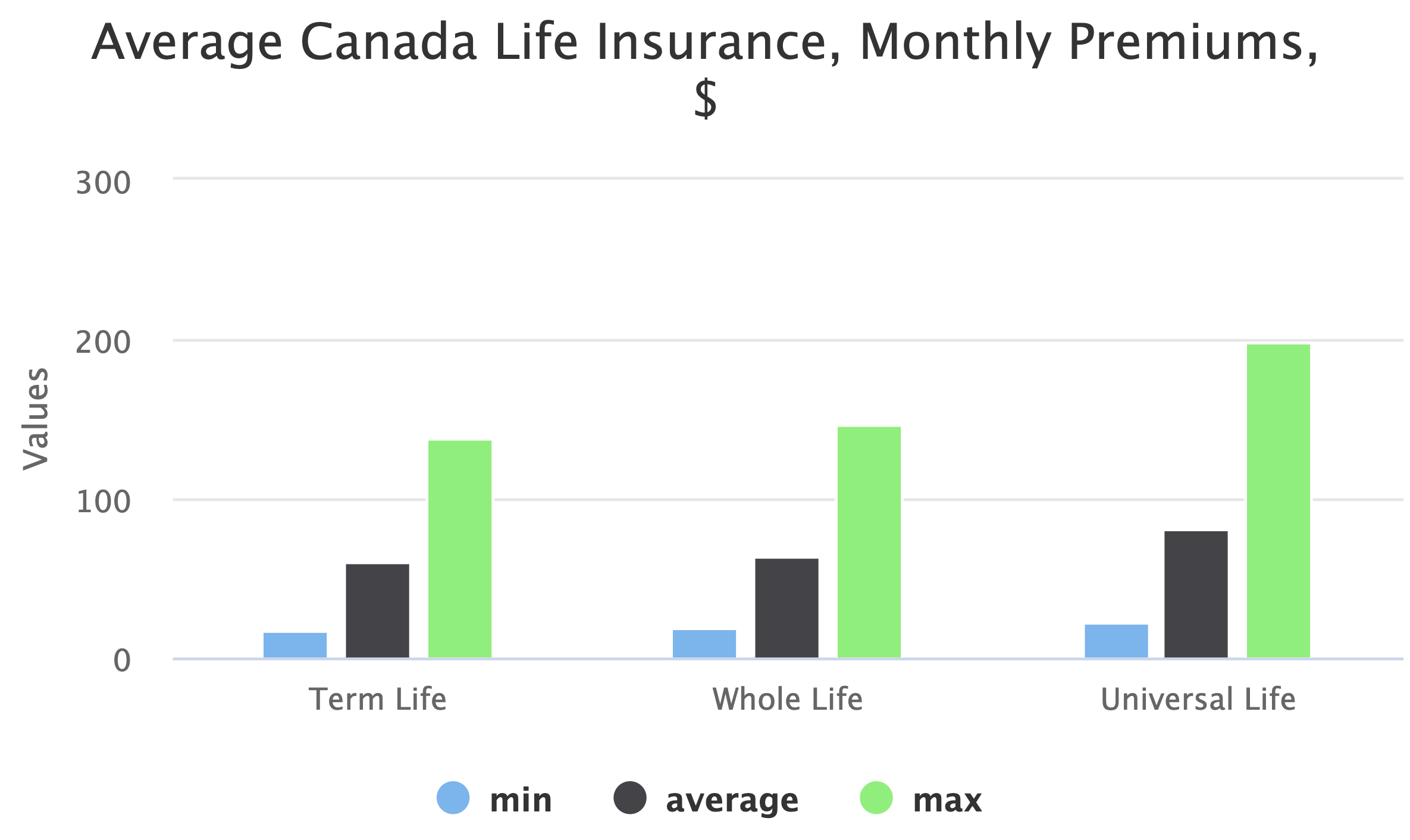

Across Ontario the average cost is approximately 121 a month. Not available in other provinces. In Toronto and.

It safeguards the debt the bank made to you ensuring that your mortgage would be reimbursed in the event of your passing. Lenders will not consider you without any home insurance. Applying online is quick and easy.

Mortgage loan insurance premiums range from 06 to 450 of the amount of your mortgage. If you have paid off your home or can pay for it with cash then technically you dont need to have home insurance. There is no law in Canada that states a homeowner has to have home insurance.

To protect your family and your new digs mortgage life insurance can be a good option. Home insurance is not legally required in Canada if your house is fully paid for but you will need to purchase home insurance in order to get a mortgage. But your lender making it seem like it is.

Ad Mortgage Insurance for a male and female both non-smokers and average health. Or some clients may decide to get home insurance for the first year just to satisfy the mortgage conditions. By Jason Reynold Goveas.

Policy obligations are the sole.

Is Mortgage Life Insurance Mandatory In Canada Policyme

Is Mortgage Life Insurance Mandatory In Canada Policyme

The Baum Law Firm Law Firm Attorneys Lawyer

Life Insurance Ontario Rates Online Quotes Tips For Ontarians

Looking For A Quality Realtor We Know A Few Check Out This Profile Of Ontario S Real Estate Profess Real Estate Professionals Real Estate Real Estate News

Select The Best Civil Lawyer In Ontario Good Lawyers Family Law Ontario

Buying Selling Investing Ontario Homeowners Insurance Homeowner Home Mortgage

What Is Mortgage Insurance Updated 2022 Policyadvisor

What Determines Your Auto Insurance Rate Financial Services Regulatory Authority Of Ontario

![]()

Mortgage Insurance Vs Life Insurance 2022 Protect Your Wealth

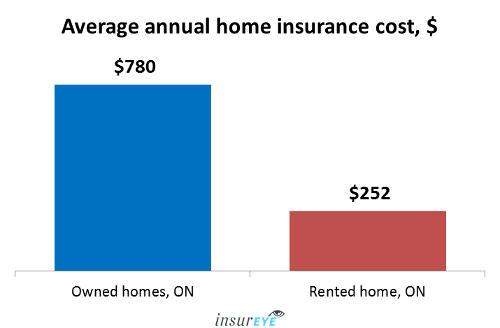

The Average Home Insurance Cost In Ontario 780 Year

Mortgage Insurance Vs Life Insurance 2022 Protect Your Wealth

![]()

Mortgage Insurance Vs Life Insurance 2022 Protect Your Wealth

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security

What Types Of Insurance Does Your Small Business Need Small Business Insurance Business Insurance Commercial Insurance

What Is Mortgage Insurance Updated 2022 Policyadvisor

Best Life Insurance Canada 2022 Company Reviews Policyadvisor

Climate Change Has Caused Ontario And Alberta Home Insurance Rates To Increase By 64 Per Cent And 140 Per Cent Respectively Ratesdotca

Mortgage Default Insurance Cmhc Insurance Calculator Ratehub Ca